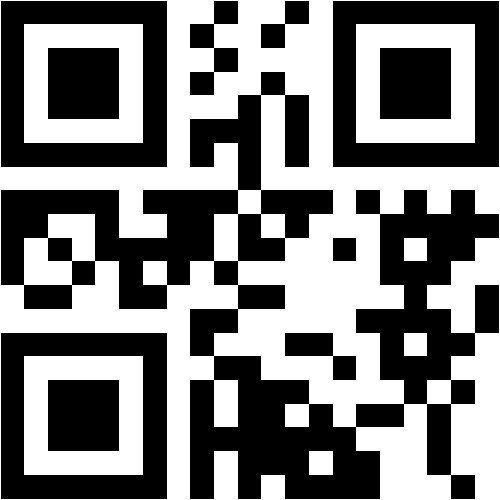

krishnamohan

@rvrjcce.ac.in

Assistant Professor and Information Technology

RVR&JC College of engineering

RESEARCH INTERESTS

Deep learning

Scopus Publications

Scholar Citations

Scholar h-index

Scholar i10-index

Scopus Publications

M. Durairaj, Ch. Suneetha, and BH. Krishna Mohan

Frontier Scientific Publishing Pte Ltd

<p class="Abstracttitle">A financial time series is chaotic and non-stationary in nature, and predicting it outcomes is a very complex and challenging task. In this research, the theory of chaos, Long Short-Term Memory (LSTM), and Polynomial Regression (PR) are used in tandem to create a novel financial time series prediction hybrid, Chaos+LSTM+PR. The first step in this hybrid will determine whether or not a financial time series contains chaos. Following that, the chaos in the time series is modeled using Chaos Theory. The modeled time series is fed into the LSTM to obtain initial predictions. The error series obtained from LSTM predictions is fitted by PR to obtain error predictions. The error predictions and initial predictions from LSTM are combined to obtain final predictions. The effectiveness of this hybrid is examined by three types of financial time series (Chaos+LSTM+PR), including stock market indices (S&amp;P 500, Nifty 50, Shanghai Composite), commodity prices (gold, crude oil, soya beans), and foreign exchange rates (INR/USD, JPY/USD, SGD/USD). The results show that the proposed hybrid outperforms ARIMA (autoregressive integrated moving average), Prophet, CART (Classification and Regression Tree), RF (Random Forest), LSTM, Chaos+CART, Chaos+CART, and Chaos+LSTM. The results are also checked for statistical significance.</p>

Dr. M. Durairaj and B. H. Krishna Mohan

Springer Science and Business Media LLC

Srinivasa Rao Dhanikonda, Ponnuru Sowjanya, M. Laxmidevi Ramanaiah, Rahul Joshi, B. H. Krishna Mohan, Dharmesh Dhabliya, and N. Kannaiya Raja

Hindawi Limited

More than 66 million people in India speak Telugu, a language that dates back thousands of years and is widely spoken in South India. There has not been much progress reported on the advancement of Telugu text Optical Character Recognition (OCR) systems. Telugu characters can be composed of many symbols joined together. OCR is the process of turning a document image into a text-editable one that may be used in other applications. It saves a great deal of time and effort by not having to start from scratch each time. There are hundreds of thousands of different combinations of modifiers and consonants when writing compound letters. Symbols joined to one another form a compound character. Since there are so many output classes in Telugu, there’s a lot of interclass variation. Additionally, there are not any Telugu OCR systems that take use of recent breakthroughs in deep learning, which prompted us to create our own. When used in conjunction with a word processor, an OCR system has a significant impact on real-world applications. In a Telugu OCR system, we offer two ways to improve symbol or glyph segmentation. When it comes to Telugu OCR, the ability to recognise that Telugu text is crucial. In a picture, connected components are collections of identical pixels that are connected to one another by either 4- or 8-pixel connectivity. These connected components are known as glyphs in Telugu. In the proposed research, an efficient deep learning model with Interrelated Tagging Prototype with Segmentation for Telugu Text Recognition (ITP-STTR) is introduced. The proposed model is compared with the existing model and the results exhibit that the proposed model’s performance in text recognition is high.

M. Durairaj and B. H. Krishna Mohan

International Journal of Intelligent Systems and Applications in Engineering

: Financial time series are chaotic by nature, which makes prediction difficult and complicated. This research employs the new hybrid model for the prediction of FTS which comprises Long Short-Term Memory (LSTM), Polynomial Regression (PR), and Chaos Theory. First of all, FTS is tested for the presence of chaos, in this hybrid model. Later, using Chaos Theory, the time series is modelled with the chaos existence. The model time series will be entered in LSTM for initial forecasts. The sequence of errors derived from LSTM forecasts is PR appropriate for error predictions. Error forecasts and original model forecasts are applied to produce the final hybrid model forecasts. Performance testing of the hybrid model (Chaos+LSTM+PR) is conducted using three categories namely foreign exchange, commodity price and stock-market indices. The hybrid model proposed in this study, in compliance with MSE, Dstat and Theil’s U, is proved superior to the individual models like ARIMA, Prophet, LSTM and Chaos+LSTM. The execution of these various hybrid proposed methods is done mainly using Python, additionally, the authors used Gretl® and R for some methods respectively. Ultimately, the final result of this hybrid model describes with a better result than the existing prediction models and it is proved using various types of FTS like Foreign exchange rates, commodity prices, and stock market indices respectively. Hence, the result shows that the proposed hybrid models of Chaos+LSTM+PR achieved with better prediction rate than the existing models on the nine datasets executed.